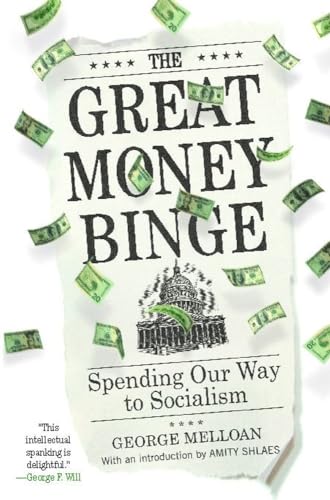

Items related to The Great Money Binge: Spending Our Way to Socialism

"synopsis" may belong to another edition of this title.

After joining the editorial page in New York in 1970, Mr. Melloan became deputy editor in 1973. In 1990, he took responsibility for the Journal’s overseas editorial pages, writing editorials and columns for the Journal’s foreign and domestic editions about such momentous events as the collapse of the Soviet Union and the open door policy that brought billions of foreign investment into China, fueling its enormous economic growth over a period of 25 years.

Mr Melloan was winner of the Gerald Loeb award for distinguished business and financial journalism in 1982 and twice in the 1980s won the Daily Gleaner award of the Inter-American Press Association for his writings about the rising Soviet influence in Central America. In 2005, he received the Barbara Olson Award for excellence and independence in journalism from The American Spectator.

Mr. Melloan lives in Westfield, N.J. He is a member of the Council on Foreign Relations and the Dutch Treat Club.

Chapter 1

The Return of the Progressives

According to the progressive narrative, which is confirmed as authentic current history by the Beltway press, the crash of 2008 was a repeat of 1929, the result of an excess of greed on Wall Street. As the 1929 story goes, Wall Street went on a speculative bender, pumped up stock prices to a point where they could go no higher, and the market crashed. That touched off the Great Depression.

The narrative continues with how the Democratic Party produced a savior in Franklin Delano Roosevelt, who led the country out of the Depression through the extraordinary use of government power to create jobs. The latest chapter in the progressive narrative awards the FDR role to Barack Obama in today's unquiet times and assures the American people that he will lead them out of the current malaise, also through the extraordinary use of government power. Extraordinary in this instance refers to massive employment of the government's power to borrow and create money.

It would make a nice story if it were true. But it is mostly bunk. Wall Street didn't bust up the U.S. economy in 1930. The Dow Jones average had recovered most of its two-hundred-point "Crash" dive of October and November 1929 by April 1930. So Wall Street's wild high jinks born of the unparalleled 1920s prosperity didn't "cause" the Depression. That version has had much popular appeal presumably because it conforms to the biblical warnings of excess-cum-retribution. It has been told repeatedly because its antibusiness bias has neatly fitted the mind-set of progressive college professors, historians, and journalists over the decades.

As some excellent economic historians have effectively demonstrated in a recent outpouring of scholarly revisionism, government policies caused the Depression. The primary blame lies with the Republican Party (progressives will at least agree to that). Herbert Hoover and Congress -- seeing the crisis as an opportunity, if that sounds familiar -- raised taxes and tariffs. The Federal Reserve, a government bank, did its bit by tightening money at exactly the wrong time. The recovery from the Crash -- a downturn that was no more dramatic than some on Wall Street before and since -- was beginning in spring 1930. But that rebound was aborted by the sudden slowdown in U.S. foreign trade brought about by the radical Smoot-Hawley tariff bill and by the higher taxes Hoover and Congress imposed on Americans. The economy went into a downward spiral that did not bottom out until 1933.

Hoover, carrying only six states, was deservedly trounced by FDR in 1932. Roosevelt ran on a conservative platform, promising to abandon "protective" tariffs, cut federal spending, balance the budget, maintain a sound dollar, and restore order in the banking system, which was plagued by bank failures and runs on banks, caused in the main by the inept management of the young Federal Reserve System that had simply starved the banks for cash. The Fed had been founded only sixteen years before the Crash, after eighty years in which the United States had had no central bank, thanks to the abolition of the second Bank of the United States by Andrew Jackson. Somehow economic growth and technological development survived the absence.

Once in office, FDR did indeed relieve the bank problem. Exercising arbitrary powers, which presaged much that would come later, he ordered closure of the nation's banks for a week. Demonstrating the political skill that would keep him in office for over twelve years until his death, he artfully called the shutdown a "bank holiday." In his first "fireside chat" with an anxious nation he explained that the banks would be inspected by an army of bank examiners during the "holiday," and only those that were sound would be allowed to reopen. He also established the Federal Deposit Insurance Corp. (FDIC) to insure deposits with premiums paid by the banks. It was a rather naked exercise of presidential power, but it worked. Americans took their money out of the mattresses and put it back into the banks. The economy began a feeble recovery.

Had Roosevelt stopped there with his use of federal muscle and fulfilled his other campaign promises, the recovery would have gained steam. But he soon fell under the spell of his progressive advisers, and having once used government power to good effect, he couldn't resist the temptation to extend his control over the economy and in the process waged a war of words against private business from the White House. His policies put a chill on new private investment and retarded the recovery that was struggling to be born. He nonetheless won reelection handily in 1936, thanks in part to heavy support from organized labor. After that came "the second New Deal" with more federal meddling resulting in an economic relapse that would prolong the Depression, for all practical purposes, until mobilization for World War II. Winning the war sowed the seeds for a genuine economic recovery, but that recovery did not get under way until a few years after the war ended, thanks to the New Deal legacy.

This record is cited not to totally destroy the frequent claims that FDR was a "great" president. That's a purely subjective judgment. He was both hated and worshipped by many Americans in his day. Hardly anyone was neutral in his view of FDR, and many of those attitudes still exist over six decades later. There is no denying that he had remarkable political skills that served the country well, for a short time at least, in regaining its balance from the buffeting the economy suffered from the magisterial meddling of Herbert Hoover. His wartime leadership was also inspiring, although his deals with the Russians as an old and sick man stained his record when it was learned that he had effectively sold out Eastern Europe to Josef Stalin at the Yalta Conference in 1944.

These are but a few historical vignettes. But I recite them here to give some perspective to the legend being manufactured by modern progressives on behalf of their 1930s ancestors to justify the massive economic intervention by Barack Obama and a Democratic Congress. They have argued that we are in another economic crisis, and they have taken measures that threaten to abort yet another natural, cyclical economic recovery that began to show signs of life in spring 2009 with a cautious recovery of the stock market and signs that the home price decline was bottoming out in some markets. The new progressives, like their New Deal forerunners of the 1930s, have put forth drastic and incredibly costly measures to expand government power over key industries: autos, energy, health care, education, and particularly banking. Just as in the 1930s, government interventions, both existing and proposed, have diminished the business confidence needed to restore investment and economic growth. These measures have drawn heavy criticism from prominent economists. The Obama administration is building up trillions of dollars of debt obligations that threaten to cripple the ability of the U.S. economy to function, not just in the distant future but in the near term.

Harking back to the false narrative of 1929, the progressive story of our own times blames their longtime bogeymen, business and Wall Street, for the untoward events of 2008. In this version, a "greedy" Wall Street peddled toxic securities to unsuspecting investors and when the investors learned what trash they were holding, the securities market locked up and stocks crashed, touching off a recession. This story is partly true, but it leaves out a rather crucial element, the key role the U.S. government and the Democratic Party played in creating the crisis and has since played in using it to justify totally irresponsible expenditures of taxpayer money, which of course further expands the future risks and obligations for taxpayers that will result from the government's unprecedented need to borrow.

The 2008 slump was not caused by Wall Street "greed." It was caused by the combination of irresponsible federal monetary policy and government intervention in the mortgage credit markets that spawned greed -- on Main Street as well as Wall Street -- and turned it into folly. As in 1930, the problems in the securities markets were compounded by further clumsy federal interventions undertaken by the Bush administration and the Federal Reserve. Mr. Obama and his Treasury secretary, Timothy Geithner, have attempted a rescue, but so far the rescue attempts look more like something Dudley Do-Right would be guilty of rather than the skilled work of the Lone Ranger. The outcome could be something similar to what happened in the 1930s, or worse, according to forecasts by some very respectable economists.

History seldom repeats itself. Just after the September 2008 crash, Wall Street Journal editorial writer Brian Carney interviewed ninety-three-year-old Anna Schwartz, who forty-five years earlier had coauthored with the late Milton Friedman the famous A Monetary History of the United States, 1867-1960. Over her long career as a monetary economist she has proved to be no fan of bank bailouts, instead arguing that banks should be allowed to fail as a means of discouraging reckless lending. She told Mr. Carney that Fed chairman Ben Bernanke and Treasury secretary Henry Paulson were fighting the last war (meaning the one in 1929) when they flooded the economy with liquidity after the 2008 collapse.

Later events have proved that policymakers should have paid more heed to the wisdom of a woman who had spent seventy years studying and writing about monetary policy. Bernanke and Paulson were reacting to the long-standing and valid criticism of the 1930 Fed for not supplying enough liquidity to the banks in that crucial year. There was justification to be found for that criticism in the aforementioned bank runs and failures of 1930. But in 2008, the problem wasn't a shortage of liquidity in the financial system. It was a sudden and broad loss of confidence in the face value of the mortgage-backed securities ...

"About this title" may belong to another edition of this title.

- PublisherThreshold Editions

- Publication date2013

- ISBN 10 1439164398

- ISBN 13 9781439164396

- BindingPaperback

- Number of pages304

- Rating

Buy New

Learn more about this copy

Shipping:

US$ 3.99

Within U.S.A.

Top Search Results from the AbeBooks Marketplace

The Great Money Binge Format: Paperback

Book Description Condition: New. Brand New. Seller Inventory # 1439164398

The Great Money Binge: Spending Our Way to Socialism

Book Description Paperback. Condition: Brand New. reprint edition. 304 pages. 9.20x6.10x0.80 inches. In Stock. Seller Inventory # zk1439164398